PHARMAMAR HA ACTUALIZADO FASE III LAGOON LURBINECTEDIN Y SE RETRASA SU CONCLUSIÓN HASTA ABRIL 2026.

07 mayo 2024

ZEPZELCA ( LURBINECTEDIN ) . JAZZPHARM Pone al Día " SU " Fármaco . Enfatiza el Ensayo de Primera Línea y Deja Claro Que la FDA No Solo Pide PFS ... También Pide " OS " . La PFS Podría Saberse a Principios 2025 ... La OS ¿? . Jazz Cerró la Fase II de Basket ...

En Caso de Aprobación del Ensayo de FASE III IMFORTE EN EEUU ... Lógicamente Serían ROCHE Y JAZZPHARMA QUIENES VENDERIAN EL TRATAMIENTO ... Para PHARMAMAR Quedaría lo Estipulado en el Contrato Alcanzado Con JazzPharma .

Mientras el Ensayo de Fase III LAGOON Qué Lleva a Cabo PHARMAMAR en el Intento de Poder Alcanzar la FULL APPROVAL Para el Tratamiento de Segunda Línea SCLC Ha Sufrido un Retraso de 10 Meses ... Hasta Abril 2026 ... Y A Fecha de Hoy Continúa en el Intento de Reclutar Pacientes :

LUNG CÁNCER . Científicos del Reino Unido ( Univ de Oxford ) están Creando la Primera Vacuna Contra el CÁNCER DE PULMÓN DEL MUNDO . LUNGVAX es una Vacuna Que Activa el Sistema Inmunológico Para Matar las Células Cancerosas y Detener el Cáncer de Pulmón Utilizando una Cadena de ADN /./ A Destacar También ROCHE Con la COMBINACIÓN DE ATEZOLIZUMAB CON VACUNA DE CÉLULAS DENDRÍTICAS .

" Estamos en una Época Dorada de la Investigación y éste es uno de los Muchos Proyectos Que Esperamos Transformen la SUPERVIVENCIA al Cáncer de Pulmón ".

Los Datos de Cancer Research UK Muestran Que Hay Alrededor de 48.500 Casos de Cáncer de Pulmón Cada Año en el Reino Unido .

Por Primera Vez en el Mundo , Investigadores de la Universidad de Oxford, el Instituto Francis Crick y el University College London (UCL) han Utilizado la Tecnología Similar a la Vacuna Oxford-AstraZeneca Covid-19 Para Crear ' LUNGVAX ' Para Aquellos con alto Riesgo de Padecer Cáncer de Pulmón .

LungVax es una Vacuna Que Activa el Sistema Inmunológico Para Matar las Células Cancerosas y Detener el Cáncer de Pulmón Utilizando una Cadena de ADN .

Luego, la Vacuna Entrena al Sistema Inmunológico Para Que Reconozca las Proteínas de " Bandera Roja " en las Células de Cáncer de Pulmón, Conocidas Como Neoantígenos, y las Elimine .

Esos Neoantígenos Aparecen en la Superficie de la Célula Debido a Mutaciones Que Causan Cáncer Dentro del ADN de la Célula . ...

*******************

*************

*******

A Destacar También ROCHE Con la COMBINACIÓN DE ATEZOLIZUMAB CON VACUNA DE CÉLULAS DENDRÍTICAS EN PACIENTES CON CÁNCER DE PULMÓN MICROCÍTICO ( VENEZO-LUNG ) .

06 mayo 2024

SMALL-CELL LUNG CÁNCER . IMFINZI By ASTRAZÉNECA . According To Findings From The PHASE III ADRIATIC Trial : Improvements In OS And PFS Led To The Trial Meeting It's Dual Primary End Points .

ASTRAZÉNECA YA HA COMUNICADO QUE ENVIARÁ ESTOS RESULTADOS A LAS AUTORIDADES REGULADORAS GLOBALES PARA SU REVISIÓN .

ES EL PRIMER ENSAYO A NIVEL MUNDIAL DE INMUNOTERAPIA DE FASE III QUE OFRECE UNA MEJORA SIGNIFICATIVA Y CLÍNICAMENTE SIGNIFICATIVA EN LA SUPERVIVENCIA EN ESTE ENTORNO .

LAS MEJORAS EN LA OS Y LA SSP LLEVARON AL ENSAYO A ALCANZAR SUS DOS CRITERIOS DE VALORACIÓN PRINCIPALES ( OS Y OFS ) .

Los Pacientes con Cáncer de Pulmón de Células Pequeñas en Estadio Limitado ( LS-SCLC ) Sin Progresión Después de Quimiorradioterapia ( TRC ) Concurrente Tratados con Terapia de CONSOLIDACIÓN con DURVALUMAB ( IMFINZI ) Experimentaron una Mejora Estadísticamente Significativa y Clínicamente Significativa en la SUPERVIVENCIA General ( OS ) y la SUPERVIVENCIA Libre de Progresión. ( PFS ) Frente a PLACEBO, Según los Hallazgos del Ensayo de FASE III ADRIATIC (NCT03703297) .

Además, no se observaron nuevas señales de seguridad para durvalumab y la seguridad del agente en el ensayo fue consistente con su perfil conocido .

" Muchos pacientes tratados por LS-SCLC se enfrentan a la recurrencia de la enfermedad y el estándar de atención se ha mantenido sin cambios durante décadas ", afirmó Suresh Senan, PhD, profesor de Radioterapia Clínica Experimental en el Centro Médico de la Universidad de Ámsterdam en los Países Bajos e investigador principal del ensayo. en el comunicado de prensa .

"ADRIATIC es el Primer Ensayo Mundial de INMUNOTERAPIA de FASE III Que Ofrece una Mejora Significativa y Clínicamente Significativa en la SUPERVIVENCIA en este Entorno, lo que Marca un Gran Avance Para los Pacientes con esta Devastadora Enfermedad ".

AstraZeneca Compartió Que estos Resultados se Presentarán en una Futura Reunión Médica y se Enviarán a las AUTORIDADES REGULADORAS GLOBALES Para su Revisión .

La Evaluación de la Eficacia de TREMELIMUMAB Cuando se Agrega a DURVALUMAB, un Criterio de Valoración Secundario Clave en el Segundo Grupo Experimental, Sigue Siendo Ciega y Continuará con el Siguiente Análisis Planificado . ...

05 mayo 2024

04 mayo 2024

03 mayo 2024

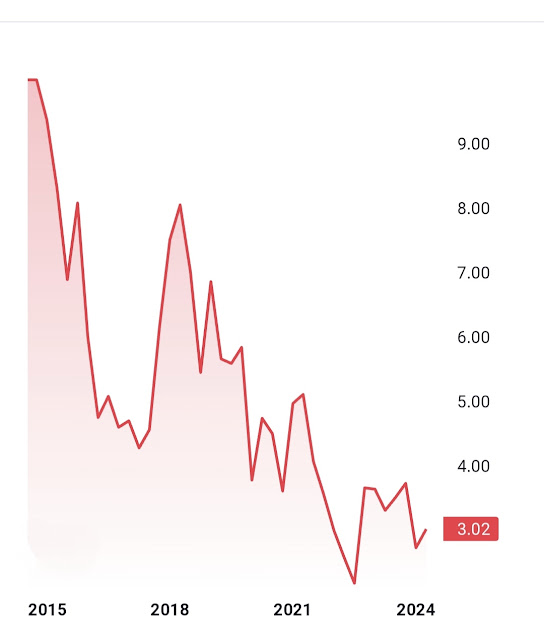

LURBINECTEDIN FASE III LAGOON . Otro Punto de Vista By Javiro ( Rankia ) . Las Nuevas Fechas de LAGOON . El Retraso de un Ejercicio Podría Trastocar Tanto Ingresos en Ventas ... Como Más Gastis en I+D . La Clave es Que No Surjan Nuevas Demoras Porque Si es Así la Caja Neta de Pharmamar Estaría a Cero Ya en 2027.

Al haber añadido más hospitales (los de Japón) es lógico que haya que posponer las fechas de finalización del ensayo . El problema es que este hecho repercutirá en el inicio de la comercialización del Zepzelca para 2L en Europa, que se retrasará un ejercicio. El daño de esta dilación es doble: por un lado se deja de ingresar en ese año de retardo y por otro lado en esos doce meses se seguirá quemando cash por alargamiento del ensayo.

AstraZeneca Admite Que Su Vacuna Contra el Covid-19 Puede Provocar Efectos Secundarios Como la TROMBOSIS . Algo Que se Dijo Desde el Minuto Zero ... Ahora Vendrán Denuncias ... Pero Resulta Que era una VACUNA NO APROBADA Y NADIE OBLIGÓ A VACUNAR .

LOS NO VACUNADOS AGUANTARON CARROS Y CARRETAS ... SE MANTUVIERON FIRMES Y AHORA EL TIEMPO LES HA DADO LA RAZÓN .

02 mayo 2024

VENTAS OBTENIDAS Por JazzPharma Con LURBINECTEDIN US en el Primer Trimestre 2024 : 75,1 Millones $ . /.. / . Versus los 74 Millones Alcanzados en el Cuarto Trimestre 2023 o los 78 Millones Alcanzados en el Tercer Trimestre 2023 . Teniendo en Cuenta Que Continúa la Escasez de Platinos en el Mercado Desde el Tercer Trimestre 2023 .

|

| " Comunicado de JazzPharma en el Tercer Trimestre 2023 ". |

PHARMAMAR Ha Actualizado la Fase I-II Que Se Inició en 2016 Con la Combinación entre LURBINECTEDIN y IRINOTECAN . La Conclusión del Ensayo Ha Pasado de Ser Para Noviembre 2023 a Marzo 2026 ... El Ensayo Clínico Continúa Reclutando Pacientes .

FASE I-II Con LURBINECTEDIN in Combination With IRINOTECAN Pharmacokinetic Study in Patients With Selected Solid Tumors ... Continúa en el Intento de Reclutar 320 Pacientes .

Estimated Enrollment :

320 Participants

| Allocation : | Non-Randomized | |||||||

| Intervention Model : | Parallel Assignment | |||||||

| Intervention Model Description : | Patients with selected advanced solid tumors will be divided into 3 groups: the Lurbinectedin Escalation Group, the Irinotecan Escalation Group and the Intermediate Escalation group. Each group will have a different dose escalation scheme . |

|

PHARMAMAR Ha Actualizado el Ensayo Clínico de Fase III LAGOON Con LURBINECTEDIN Small Cell Lung Cancer en el Intento de Poder Obtener la FULL APPROVAL ... Y HA RETRASADO SU CONCLUSIÓN 10 MESES .... HASTA ABRIL 2026 . POR LO QUE EN CASO DE APROBACIÓN YA SERÍA COMO MÍNIMO PARA 2027 .

El Ensayo Clínico de FASE III ( LAGOON ) Qué Lleva a Cabo PharmaMar en Solitario en el Intento de Alcanzar la Full APPROVAL en EEUU y la Aprobación en Europa ... Se Inició el 10 de Diciembre del 2021 Por lo Que Lleva 28 Meses Intentando Conseguir Reclutar 705 Pacientes Y Conseguir Batir al TOPOTECAN ... Algo Que a Fecha de Hoy Ningún Tratamiento lo Ha Conseguido en FASE III ... Por lo Que TOPOTECAN Continúa Siendo el Único Tratamiento Que Cuenta con una FULL APPROVAL de la FDA y Por Tanto es Tratamiento STANDAR en SEGUNDA LÍNEA SMALL-CELL LUNG CÁNCER .

.png)

%20(2).jpeg)

%20(1).jpeg)

.jpg)